This article is part of a larger series on Business Financing.

TABLE OF CONTENTSIf you are applying for an SBA 7(a), SBA 504, or SBA Disaster Loan from the Small Business Administration (SBA), you must fill out a personal financial statement known as SBA Form 413. Your SBA lender will use your personal financial information to help determine your company’s ability to repay a loan and its creditworthiness.

To complete SBA Form 413 quickly and easily, have your personal and company financial information organized and available. You should consider having your financial expert or accountant assist in the completion of this document.

Featured PartnerGrasshopper Bank has paid for this placement. However, our team of experts approved Grasshopper Bank as an appropriate product and our content remains editorially independent.

Explore your SBA lending solutions now with Grasshopper BankYou can download SBA Form 413 from our download widget below, or you can download it from SBA’s website.

FILE TO DOWNLOAD OR INTEGRATE

Download the SBA Form 413 PDF

Download as PDF

Businesses applying for an SBA 7(a) loan, SBA 504 loan, or an SBA Disaster Loan must include a personal financial statement in their loan application package. Each of the following people must complete and provide their own personal financial statement:

If the type of SBA loan you apply for requires you to provide SBA Form 413, and you file a joint tax return, your spouse’s information must be included. This doesn’t mean your spouse will be a guarantor on the loan, but including your spouse’s financial information informs the SBA and your lender that you have joint assets and liabilities. Your combined assets and liabilities must be reported unless a legal document, such as a prenuptial agreement, specifically separates certain assets.

Completing the form will be easier if you gather your financial documents in advance. Collect paperwork that reflects your assets and liabilities from the last full month. For example, if you fill out the form on Dec. 8, 2023, you should gather documents with information as of Nov. 30, 2023.

The financial information you will need includes:

Once collected, you’ll want to store this paperwork in an accessible location, as you will likely need to reference it throughout the SBA loan process. With this preliminary work done, you’re ready to begin filling out the rest of the SBA personal financial statement form. If you have all your paperwork gathered and organized, filling out the rest of the form is relatively simple. Depending on how many assets and liabilities you have, SBA Form 413 could take as little as 15 minutes to complete.

Once you have all of your documents gathered, you are ready to complete Form 413. Follow each section below for detailed instructions on how to complete the form.

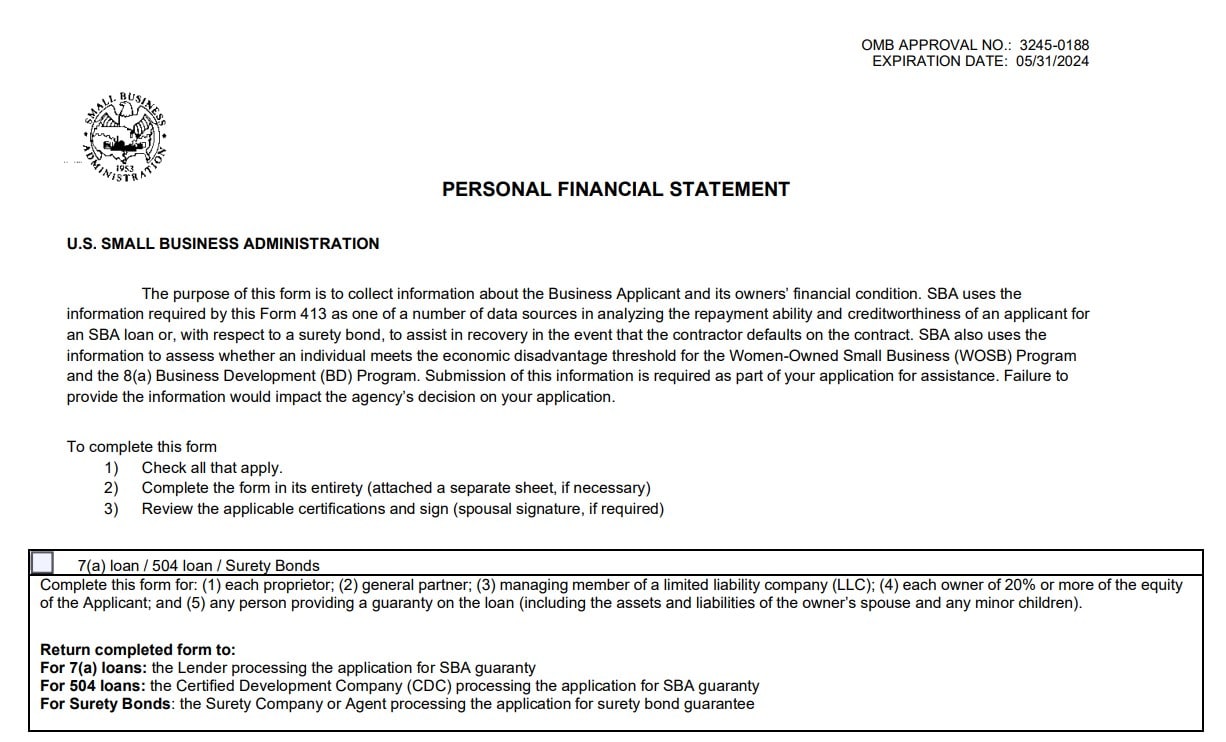

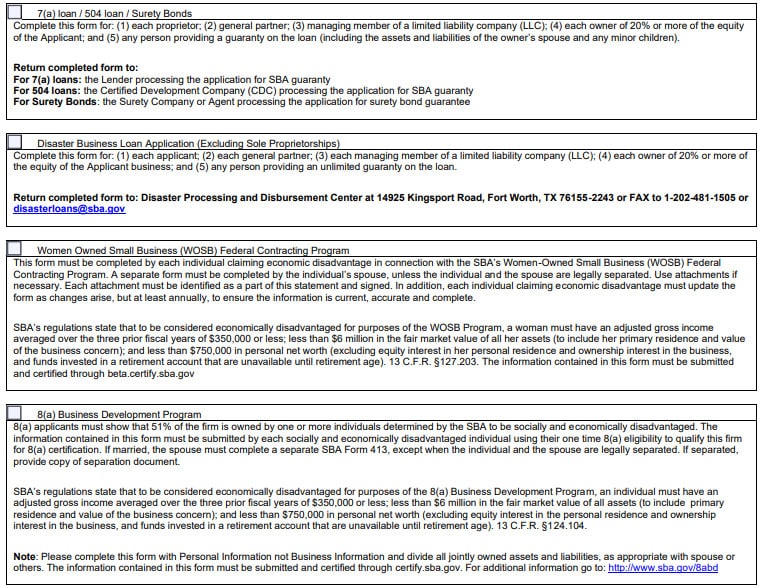

On the first page, you will check all the boxes that apply to your loan:

You may end up checking more than one box. See the image below for details on each section of page one.

Page 1 of SBA Form 413. Check all boxes that apply.

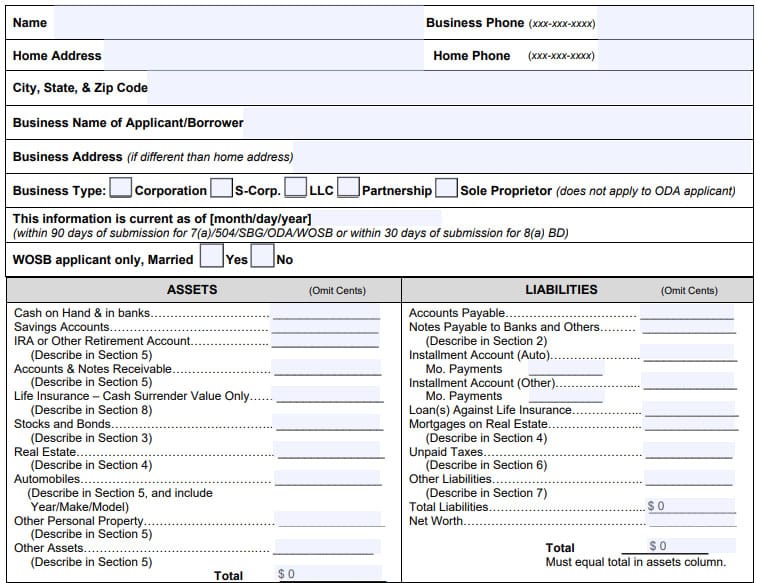

The top portion of page two requires your name, address, phone numbers, and business name. This is followed by a summary section for your assets and liabilities. As strange as it may seem, it’s best to complete the assets and liabilities sections last. These sections summarize information contained in the other sections throughout the form. Complete sections one through eight first, then use the information from those sections to total your assets and liabilities.

Top section of page two of SBA Form 413. Includes personal information, assets, and liabilities. Fill out the assets and liabilities last.

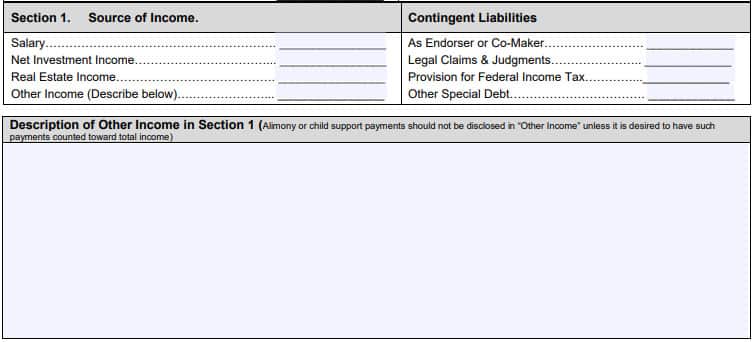

Section 1 of SBA Form 413

In this section, you’ll list your income sources and contingent liabilities. Potential income sources include income you expect to receive on a regular and recurring basis. Contingent liabilities are debts that become your responsibility if and when something else happens. For example, if you cosign a loan to buy a vehicle for someone else, you become responsible if the other person doesn’t pay. In this section, you’re summarizing the contingent liabilities you will list in the Other Liabilities section (Section 7).

Instructions for providing this information and definitions of terms used on this form are:

Instructions for providing this information and definitions of terms used on this form are:

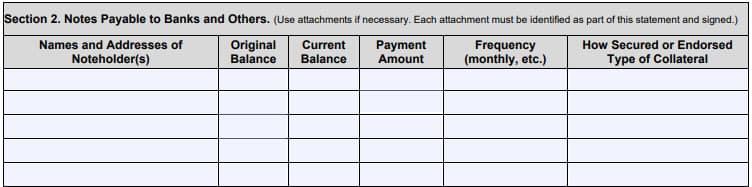

Section 2 of SBA Form 413

This section details all your debts, such as credit cards, personal loans, and installment loans. We recommend reviewing your credit report to make sure you don’t miss anything. Established businesses may also want to double-check their business credit reports.

If you don’t have enough space to list all your loans, attach another sheet of paper with the required information. You can use as many supplemental pages as needed. If you do so, make sure they all include the “as of” date on your SBA personal financial statement, reference Section 2, include the name of the business applicant, and are signed by you and your spouse.

Instructions for providing this information and definitions of terms used in this section are:

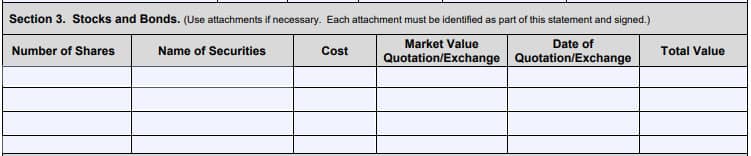

Section 3 of SBA Form 413

In this section, you’ll list the marketable securities you and your spouse own. This does not include retirement savings as that will be reported in another section of the form. If needed, you can attach supplemental pages with more entries.

Instructions for providing this information and definitions of terms used in this section are:

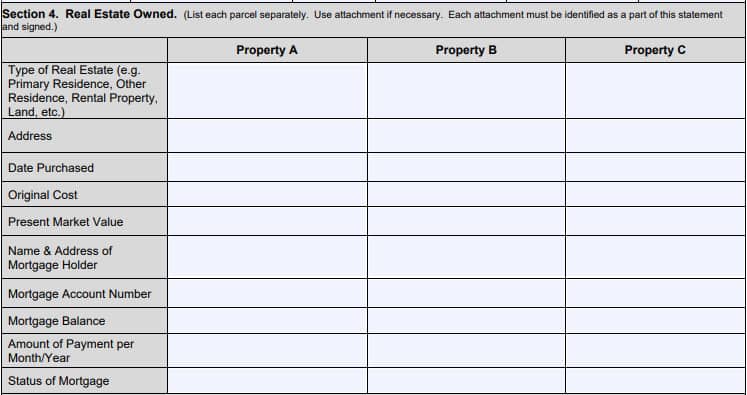

Section 4 of Form 413.

This section is where you’ll provide a detailed description of all the real estate you own in your personal name. List any property reported on your personal tax return. Property A is your primary residence if you own it. If you own more than three properties, attach supplemental sheets or a “schedule of real estate” that identifies the same information as required on the SBA personal financial statement form.

Instructions for providing this information and definitions of terms used in this section of the form are:

Section 5 of Form 413

In this section, you’ll report personal property of significant value. This includes property, such as jewelry, IRAs or other retirement accounts, cars, and recreational vehicles. For cars, include the make, model, and year along with a quick estimate of current value from a tool, such as Kelley Blue Book.

You won’t have to show documentation on the value of your business right away. However, you should be prepared to provide it in the event your lender asks for it. You can pay a consultant to provide an official business valuation, or you can estimate the value of your business and document how you made your calculation.

Section 6 of SBA Form 413

This section is available for you to provide a detailed description of any federal, state, or local taxes you owe. You should also state whether the unpaid taxes are current or delinquent. Report taxes you owe to a foreign government in the Other Liabilities section of the form.

The SBA requires you to be current on all federal, state, and local taxes before it will approve a loan. The only exception is if you have delinquent federal income taxes with an IRS-approved payment plan. The SBA also doesn’t allow you to use loan proceeds to pay for past due taxes, such as income, payroll, real estate property, or sales.

Section 7 of SBA Form 413

This section of SBA Form 413 is a catch-all where you can list any liabilities not previously disclosed on the form and described in detail. Some examples of the types of liabilities that can be found here are:

You don’t want to miss any liabilities, as your loan provider will likely find them in your credit report, and they could think you’re trying to hide something. If you’re not sure where to put a liability on the form, then make sure it’s included in this section.

Section 8 of SBA Form 413

You need to list all life insurance you or your spouse currently holds in this section of the form. List all your policies, including term, whole life, and variable life insurance. Provide the face value (death benefit) of your policy that would be provided to your beneficiaries if you die, as well as the cash surrender value of whole life insurance policies. Also, list the full names of all policy beneficiaries and the name of the insurance company that carries your insurance policies. The insurance company may not be the agent or broker you worked with to establish the policy.

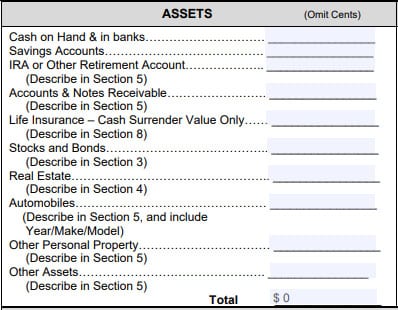

On the second page of the form, the Assets section not only summarizes the information you provided earlier as you filled out the form but also includes your cash on hand and savings account balances.

When completing this section, make sure you round up to the nearest dollar. You’ll need to list the following assets:

Add up the total of all your assets included in the prior line items. Double-check your math to make sure it adds up properly!

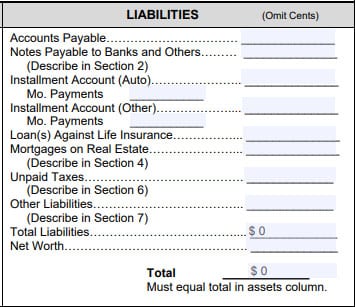

Liabilities section of Form 413

The Liabilities section not only summarizes the information you provided in the prior steps but also includes your accounts payable. With accounts payable, report the total amount of products and services purchased on credit or on a regular payment basis, excluding those using credit cards or personal lines of credit.

When completing this section, make sure you round up to the nearest dollar. You’ll need to list the following liabilities:

Then, follow the instructions for the last three items to complete this section:

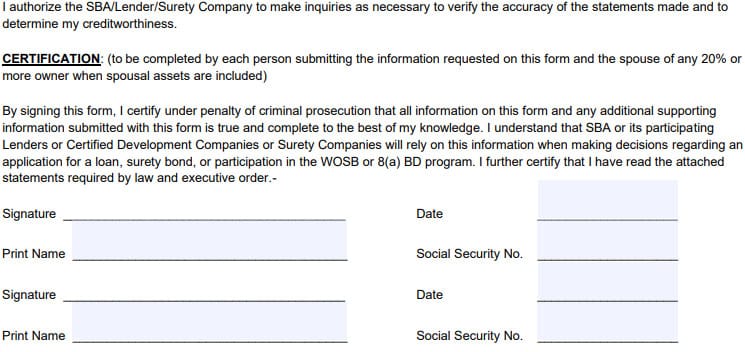

Once you complete the summary of assets and liabilities, and each person listed on the SBA personal financial statement has completed and signed the certification on page 3, you’re done preparing SBA Form 413. You’ll provide this form to your lender with your SBA loan application and other supporting documents.

If you’re ready to move forward, Lendio can help. As a marketplace, it allows you to apply once and receive the best offers from over 75 potential lenders. Stop by its website for more information or to apply.

The SBA Form 413 is a personal financial statement that is filled out when applying for an SBA 7(a), SBA 504, or SBA Disaster loan.

How to fill out PFS SBA?Gather all of your financial documents and fill out each section. Save the assets and liabilities for last as you will be able to use your other sections to help fill out those sections at the end. Have your company’s financial expert help fill these forms out. Your SBA loan provider can also give you guidance on any SBA forms that need to be completed.

What documents are needed for the SBA disaster loan?The SBA form you will need to fill out is SBA Form 1368. You will need to complete IRS Form 4506-C to give permission for the SBA to obtain your tax return. You will also need any financial documents that show that your company was negatively impacted by a disaster.

Once you’re finished completing SBA Form 413, sign and date the form, then assemble it in a binder with your supporting documents. Don’t include anything you cannot support with documentation, as your lender will likely ask you for some of it. Be prepared to provide your lender with copies upon request. And for more guidance on the business loan application process, see our guide on how to get a small business loan.

More SBA loan application forms:

Find Matthew On LinkedIn

Matt Sexton is a banking and finance expert at Fit Small Business, specializing in Business Banking. Since starting at FSB more than two years ago, he has written more than 200 articles reviewing banking and financing providers and buyer’s guides. He holds a bachelor’s degree from Northern Kentucky University and has more than 15 years of finance experience and more than 25 years of journalism experience. He has worked for both small community banks and national banks and mortgage lenders, including Fifth Third Bank, U.S. Bank, and Knock Lending.