Ritika produces ad films for a living. Driven and hard-working, she draws a good salary and diligently saves a part of it each month. However, the savings account she parks her money in pays very little interest. With the cost of living on the rise, Ritika worries that a savings bank account isn't enough.

Ritika already works hard for her money. What Ritika needs is for the money to work hard for her. One of the simplest ways to make that happen is by investing in mutual funds.

India’s first mutual fund

The story of the mutual fund in India begins with forming of the Unit Trust of India (UTI) in 1963. Brought into being by an Act of Parliament, UTI was set up and controlled by the Reserve Bank of India (RBI) until 1978. That year, the Industrial Development Bank of India (IDBI) replaced the RBI as the UTI regulator and administrative authority.

The first mutual fund scheme launched by UTI was Unit Scheme 1964 (US 64). By the end of 1988, the total market value of the UTI investments amounted to Rs 6,700 crore.

In June 1987, the State Bank of India (SBI) launched the first non-UTI mutual fund. Between 1987 and 1992, five other public sector banks set up mutual funds of their own:

The Life Insurance Corporation of India (LIC) launched its mutual fund in June 1989. The General Insurance Corporation of India (GIC) followed suit in December 1990.

By 1993, the market value of investments in the mutual fund sector had ballooned to Rs 47,004 crore.

The first private sector mutual fund was launched in 1993. The fund house that set it up—Kothari Pioneer—has since merged with Franklin Templeton.

That same year, the first Mutual Fund Regulations came into being. These regulated all mutual funds except those registered under UTI. The 1993 SEBI (Mutual Fund) Regulations were later replaced by more comprehensive and revised Mutual Fund Regulations in 1996.

Did you know?

The mutual fund sector still functions under the SEBI (Mutual Fund) Regulations of 1996 but is amended from time to time.

The entry of the private sector led to rapid growth in India’s mutual fund sector. That’s because:

By the end of January 2003, India had 33 mutual funds with total assets worth Rs 121,805 crore. Indian investors now had more fund houses to choose from.

The new millennium marked a period of growth and consolidation for the country’s mutual fund sector. In 2019–20, the industry had assets under management (AUM) worth around Rs 27 lakh crore.

Mutual funds remain very popular in India today. That’s because:

Besides, there are so many options! As a mutual fund investor, you can choose from among 43 asset management companies (AMCs) which offer more than 1,700 schemes!

*Source: AMFI and SEBI website

Ever planned a family picnic? There are always a few resourceful individuals who volunteer to do the planning. They book the venue, arrange for food, organise the transport, and make the payments as they arise. Everyone else simply contributes their share of the cost.

This analogy of a family picnic could help in understanding the concept of mutual funds.

The fund manager follows the objectives of the mutual fund scheme while allocating the pooled investment. An expert fund manager knows how to allocate the funds to different securities to generate good returns.

The returns are distributed in proportion to the number of mutual fund units that each investor holds. However, before making any pay-out, the fund house deducts certain charges. That includes fund management fees and other costs associated with running the mutual fund.

Direct investment in financial securities like stocks and bonds can be rewarding if you:

a) are knowledgeable about the markets and

b) have the time to research and monitor securities.

Don’t have the financial knowledge or the time to monitor the markets? Mutual funds offer an easier way to invest. A professional fund manager takes care of the fund portfolio based on the mutual fund scheme's predefined objectives. The fund manager monitors the asset allocation of the fund and rebalances the portfolio when required. You, as the investor, can be rest assured that your money is in good hands.

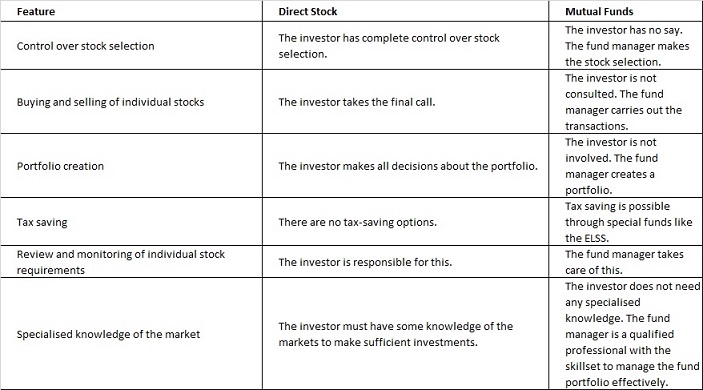

Unsure about whether to invest in stocks directly or go for mutual funds? Check the differences between the two modes of investment in the table below before making your decision.

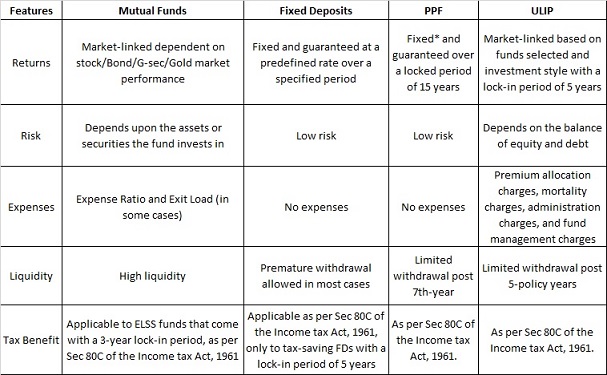

If you’re looking at how mutual funds stack up to other popular investment avenues, here’s how each one compares with the others. Knowing what each investment vehicle offers can help you make a smarter investment decision.

*Returns are fixed by the government of India every quarter

Now that we have covered how mutual funds can be a good fit for your investment needs, we move on to the next chapter. In the next chapter, Advantages of Mutual Funds, we look into the many benefits of investing in mutual funds for your financial goals and lifestyle.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100.I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Get it on mobile, Download Now

* Please note Brokerage would not exceed the SEBI prescribed limit.

Customer Care Number

Calculators Account Opening Demat Account Trading Account ICICI Bank Group websites Disclaimer : +The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning, ESOP funding etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Pay minimum 20% upfront margin of the transaction value to trade in cash market segment. Investors may please refer to the Exchange's Frequently Asked Questions (FAQs) issued vide NSE circular reference NSE/INSP/45191 dated July 31, 2020; BSE Notice no. 20200731-7 dated July 31, 2020 and NSE Circular Reference No. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. 20200831-45 dated August 31, 2020 and other guidelines issued from time to time in this regard. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

Disclaimer : ICICI Securities attempts to ensure the highest level of integrity, correctness and authenticity of the content and data updated on the site. However, we may have not reviewed all of the contents and data present on the site and are not responsible or we take no guarantees whatsoever as to its completeness, correctness or accuracy since these details are acquired from third party. In the event that any inaccuracy arises, we will not be liable for any loss or damage that arises from the usage of the content.

Features such as Advanced Charts, Watchlists, F&O Insights @ Fingertips, Payoff Analyzer, Basket Order, Cloud Order, Option Express, e-ATM, Systematic Equity Plan (SEP), i-Track, i-Lens, Price Improvement Order, Flash Trade, Strategy Builder etc., are offered by ICICI Securities. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. ICICI Securities is not making the offer, holds no warranty & is not representative of the delivery service, suitability, merchantability, availability or quality of the offer and/or products/services under the offer. Any disputes regarding delivery, services, suitability, merchantability, availability or quality of the offer and / or products / services under the offer must be addressed in writing, by the customer directly to respective merchants and ICICI Securities will not entertain any communications in this regard. The information mentioned herein above is only for consumption by the client and such material should not be redistributed.

Name of Investment Adviser as registered with SEBI : ICICI Securities Limited

Type of Registration : Non Individual

Registration number : INA000000094

BASL Membership Certificate no- BASL1136

Validity of registration : Valid till suspended or cancelled by SEBI

Registered office Address : ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400025

Telephone numbers : 022 - 6807 7100

Email id : mfadvisory@icicisecurities.com

Name of Principal Officer : Mr. Anupam Guha

Contact no : 022 - 6807 7100

Email id : mfadvisory@icicisecurities.com

Name of the Compliance officer: Mr. Nirav Shah

Contact number: 022 - 4084 0336

Email id : mfadvisory@icicisecurities.com

Name of grievance redressal Officer:- Mr. Sachin Ubhayakar

Telephone no. of grievance redressal Officer:- 022 - 6807 7400

Email id : mfadvisory@icicisecurities.com

Corresponding SEBI regional / local office address : Securities & Exchange Board of India, Plot No.C4-A, 'G' Block Bandra-Kurla Complex, Bandra (East), Mumbai - 400051, Maharashtra

SEBI Research Analyst Registration Number - INH000000990 Name of the Compliance officer (Research Analyst): Mr. Atul Agrawal Contact number: 022 - 40701000

None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors.

Disclaimer : Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Attention Investors : Prevent unauthorized transactions in your account. Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Issued in the interest of Investors (Ref NSE : Circular No.: NSE/INSP/27346, BSE : Notice 20140822-30.) It has been observed that certain fraudsters have been collecting data from various sources of investors who are trading in Exchanges and sending them bulk messages on the pretext of providing investment tips and luring the investors to invest in bogus entities by promising huge profits. You are advised not to trade on the basis of SMS tips and to take an informed investment decision based on authentic sources. issued in the interest of investor of investor (RefNSE : circular No.: NSE/COMP/42549, BSE:Notice 20191018-7)

ICICI Securities Limited:

Registered Office:

ICICI Venture House,

Appasaheb Marathe Marg,

Prabhadevi, Mumbai - 400 025, India

Tel No: 022 - 6807 7100

Fax: 022 - 6807 7803

For any customer service related queries, assistance or grievances kindly Call us at 1860 123 1122 or Email id: headservicequality@icicidirect.com to Mr. Bhavesh Soni

ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services.

Member of National Stock Exchange of India Limited (Member code: 07730), BSE Limited (Member code: 103) & Metropolitan Stock Exchange (Member code: 17680),Multi Commodity Exchange of India Limited (Member code: 56250) SEBI Registration number INZ000183631

Name of Compliance Officer (Broking) : Ms. Mamta Shetty E-mail Address : complianceofficer@icicisecurities.com / Tel No: 022-4070 1000

Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Please note Brokerage would not exceed the SEBI prescribed limit.

Margin Trading is offered as subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 and the terms and conditions mentioned in rights and obligations statement issued by I-Sec.

Account would be open after all procedure relating to IPV and client due diligence is completed.

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No: 022 - 6807 7100, Fax: 022 - 6807 7803. Composite Corporate Agent License No.CA0113. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The advertisement contains only an indication of the cover offered. For more details on risk factors, terms, conditions and exclusions, please read the sales brochure carefully before concluding a sale.

Responsible Disclosure: In case you discover any security bug or vulnerability on our platform or cyber-attacks on our trading platform, please report it to ciso@icicisecurities.com or contact us on 022-40701841 to help us strengthen our cyber security.